Which investment strategies worked best in 2021? And which will work for 2022?

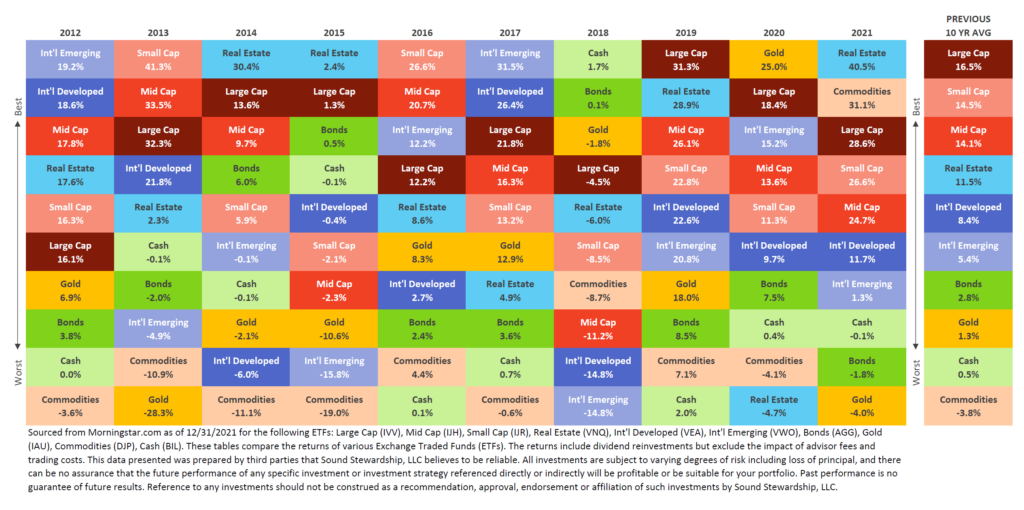

After the close of each year, I review how the stock market performed. It’s interesting to rank several types of investments using a report called the “Asset Quilt.” This stacks previous year’s results of investment types and compares them to the previous ten years.

The stock market as a whole had another great year, despite the lingering pandemic and supply chain issues.

2021 Asset Quilt

What sticks out to you as you look over this?

Here are some things I notice:

- One number doesn’t tell the whole story. These results don’t communicate the ups-and-downs traveled along the way, such as the temporary market pull-back at the end of Q3. (This is similar to how 2020’s final results don’t convey the roller coaster drop that happened for many assets before they turned around). If an investor wants the results, they often have to put up with a lot on the journey.

- Next year’s results cannot be predicted based on last year’s. Notice how Gold was at the top in 2020 and ranked last in 2021. Likewise, Real Estate was at the bottom in 2020 and ranked first last year. Chasing prior returns is tempting. That is how many investors end up frustrated.

- Long term results are more important than the short term. The basket of Commodities looks appealing for 2021 with more than 31% return – until you look at the 10-year results on the far right of the picture. If you purchased this fund on 1/1/2012, you’d still have not made back your original investment with an average annual loss of more than 3% annually.

- Diversification is key to reducing risk. Even within the categories, pockets struggled with negative returns. For instance, the Large Cap industries of healthcare, travel, & leisure were negative for the year. But the category as a whole (which includes many different sectors) was able to make up for those struggles. By owning a broad basket of companies, sectors, and investment types, you reduce the risk that one of them will hold you back.

With 2022 already starting the year with some big market swings, now’s the perfect time to step back, look at the big picture, and make sure your investment strategy is not based on emotion.

If you need help building a personal investment plan, reach out to one of our Wealth Advisors for a consultation today.

< Back to Updates