Why 2022 IRA & 401k updates could change your retirement plan

We’ve been keeping close tabs on the new 2022 IRA & 401k updates. There are several changes that could affect your retirement and philanthropic plans in the years to come. We’ll summarize those new changes here, but know that everyone’s circumstances are different; make sure to cover these changes with your wealth advisor at your next meeting.

(Don’t already have someone tracking IRA updates for you, let alone crafting you a custom, comprehensive financial plan? That’s what we’re here for. Let’s talk about how Sound Stewardship can help.)

2022 IRA Updates for ages 72* and older

Congratulations! Your Required Minimum Distribution (RMD) is most likely smaller in 2022. This means that you can keep more money invested within your IRA—and pay less taxes when withdrawing that smaller amount.

Why did RMDs go down? Minimum distributions are calculated using life-expectancy estimates, but the IRS hasn’t updated those tables since 2002. Life expectancies have risen in the past two decades, so RMDs have decreased to allow retirees to stretch their IRA funds over more years. You can dig into the IRS’s new Uniform Lifetime Table if you’d like to see the changes for yourself, otherwise, your Sound Stewardship wealth advisor would be more than happy to walk you through the new numbers. (If you are a beneficiary of an IRA, there are several factors that go into calculating your RMD; please talk to your wealth advisor for more information.)

Of course, there are reasons you may want to withdraw more than the new, lower RMD. If you are using your IRA to fund your living expenses, your annual distribution may need to be higher. In addition, many of our clients make charitable donations directly from their IRAs to satisfy the RMD. But you don’t have to reduce your charitable giving just because your RMD is lower. Anyone over 70.5 years old can transfer up to $100,000 a year tax-free to their favorite nonprofit (or single-charity donor advised fund) through a Qualified Charitable Distribution (QCD). You can continue to give at higher rates even though your RMD has decreased.

2022 IRA & 401k Updates for anyone younger than 72

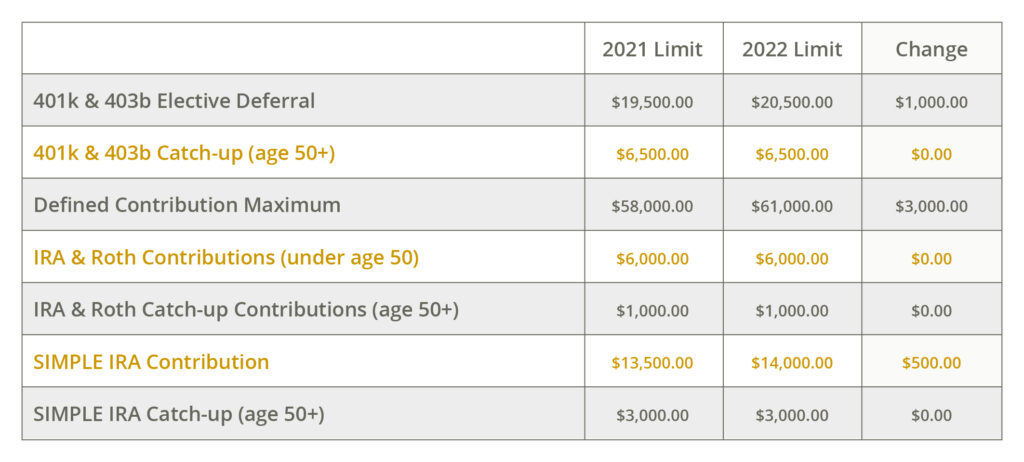

Congratulations! You will be able to contribute even more to SIMPLE IRAs & 401ks in 2022. Maximizing your savings now means having a more secure—and far more generous!—retirement later. Let’s look at the changes in contribution limits for 2022:

Again, you should meet with your wealth advisor to discuss bumping up your retirement savings contributions to meet these new limits. While you’re fine tuning your retirement plan in 2022, it’s a good time to investigate Roth IRAs. Roth IRAs let you put away after-tax income now, so you can withdraw it tax-free later (after age 59.5). Ask your employer if they offer Roth capabilities for your 401k contributions and ask your wealth advisor if a new Roth account or a Roth Conversion from an IRA is right for you.

Want to know how these 2022 IRA & 401k updates impact your specific retirement and giving plans? Contact our team of wealth advisors for a detailed review.

*2019’s SECURE Act raised the age limit for required IRA distributions from 70.5 to 72. There is some legislation in the works (the Securing a Strong Retirement Act) that could push the RMD age up to 75 over the next decade. We’ll continue to track these changes and keep you updated!

< Back to Updates